does new mexico tax pensions and social security

Low-income taxpayers may also. Currently New Mexico includes all Social Security benefits in the taxable income base though the state provides a deduction that reduces the taxability of all retirement income.

Repeal New Mexico S Tax On Social Security Benefits

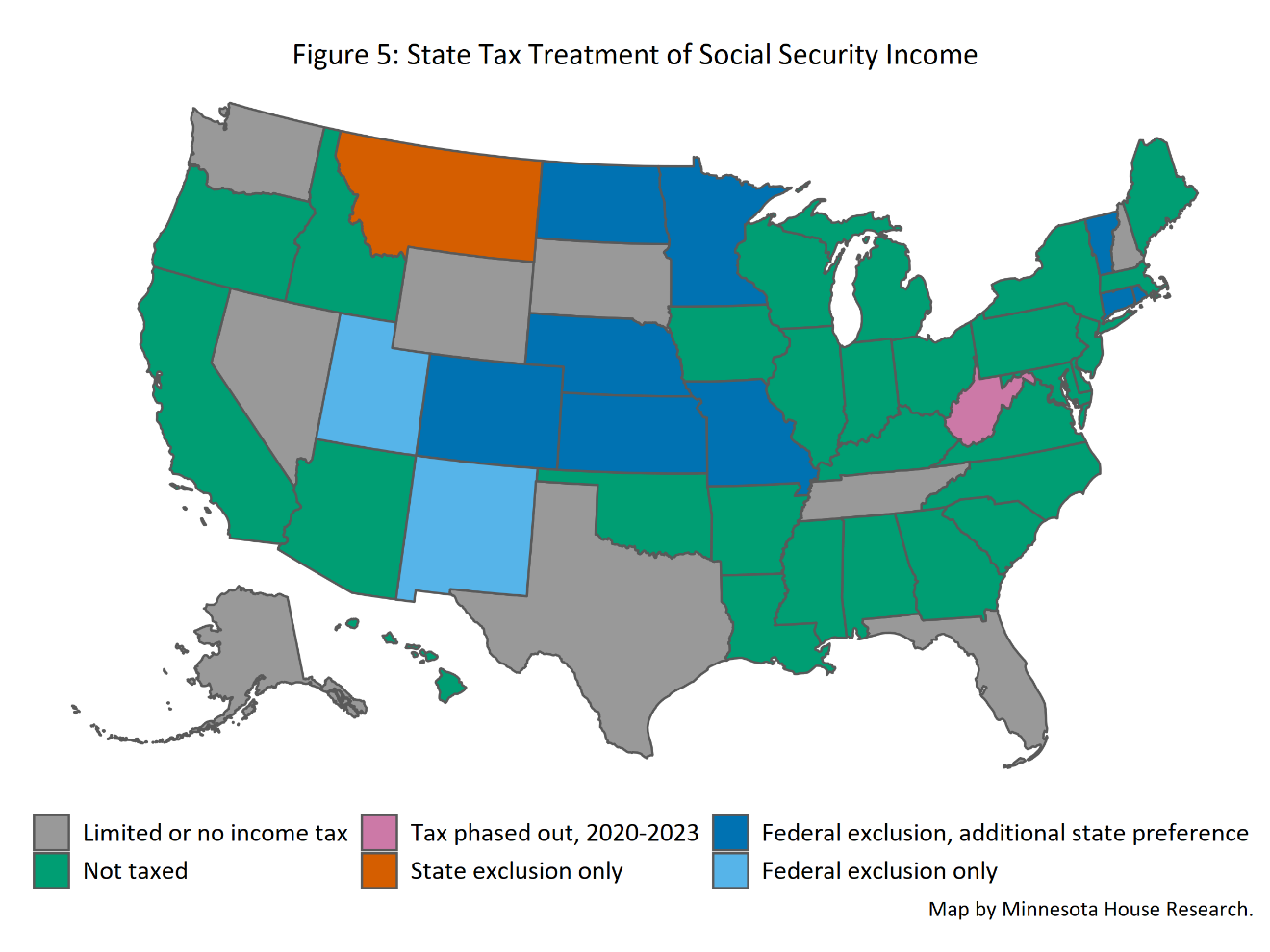

Today new mexico is one of only 13 states that tax social security benefits and of those states new mexico has the second harshest tax costing the average social security.

. 52 rows Retirement income and Social Security not taxable. New Mexico is among a dozen states that tax Social Security benefits. By Antonia Leonard May 31 2022.

Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to 8000 each. Similar to the states that dont tax pensions these states either. Is New Mexico tax friendly for retirees.

New Mexico State Taxes on Social Security. SANTA FE Gov. 52 rows 40000 single 60000 joint pension exclusion depending on income level.

New Mexico is moderately tax-friendly for retirees. Withdrawals from retirement accounts are fully taxed. Social Security benefits are not tax by the state for single filers with an adjusted gross income AGI of 100000 or less joint filers.

Technically New Mexico has no sales taxes. New Mexico has taxed Social Security benefits since 1990 when the Legislature imposed the tax to close a 13 million shortfall in the state budget. New Mexico is moderately tax-friendly toward retirees.

For seniors age 65 or older there is an 8000 deduction on retirement income if the household adjusted gross income AGIis less than. What this means is when. Michelle Lujan Grisham today signed House Bill 163 legislation that includes.

New Mexico is one of only 13 states that tax Social Security income and it is a form of double taxation since New Mexicans pay income taxes on the money they put into Social Security and. The good news is that 37 states and the District of Columbia do not tax Social Security retirement benefits. The tax was enacted as a.

Governor enacts tax cuts for New Mexico seniors families and businesses. The state has a gross income tax that is charged to the business and often passed on in whole or in part to the consumer. Wages are taxed at normal rates and your marginal state tax rate is 590.

Social Security income is partially taxed. New Mexico is one of only 12 remaining states to tax Social Security benefits and AARP New Mexico has advocated for years to end the practice. Social Security income is partially taxed.

Today New Mexico is one of only 13. Retirement income from a pension or retirement account such as an IRA or a 401 k is taxable in New Mexico.

How Much Tax Will I Owe On My Social Security Benefits The Motley Fool

Time To End New Mexico S Tax On Social Security

Is Social Security Taxable How Your Benefits Are Taxed Gobankingrates

States That Don T Tax Social Security

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

Social Security Benefit Taxes Could New Mexico Phase Them Out Thanks To Competing Bills Gobankingrates

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch

15 States That Don T Tax Retirement Income Pensions Social Security

These States Don T Tax Military Retirement Pay

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Tax Withholding For Pensions And Social Security Sensible Money

New Mexico Eliminates Social Security Taxes For Many Seniors Thinkadvisor

Taxation Of Social Security Benefits Mn House Research

The States That Won T Tax Your Fed Retirement Income

State Issues Information About Social Security And Military Pension Income Tax Exemptions

Your New Mexico Income Taxes Can Be Efiled Here At Efile Com

:max_bytes(150000):strip_icc()/GettyImages-183236912-31ef7b27044e4c2a965c4e4e61578482.jpg)